Uncategorized

👨🏿🚀TechCabal Daily – Fawry makes a splash

TGIF!

Our friends at Founders Connect have produced a documentary exploring the Nigerian banking industry. It features Sterling Bank—a tier-2 commercial bank—tracing its origins from a merger of multiple banks and how it leveraged technology to redefine banking services in the country. You can watch it here.

Flutterwave, the fintech giant, has acquired a Payment System License from the Bank of Zambia to expand its payment solutions in the country as it continues its relentless growth march across the continent.

M&A

Fawry acquires stakes in three tech startups for $1.6 million

Fawry, Egypt’s fintech unicorn, has invested EGP 80 million ($1.6 million) to acquire stakes in three Egyptian tech firms: Dirac Systems (51%), Virtual CFO (56.6%), and Code Zone (51%). The move is part of its broader strategy to strengthen its B2B fintech vertical, Fawry Business.

Dirac Systems, which counts large retail chains like Coca-Cola among its clients, specialises in enterprise resource planning (ERP) solutions that streamline business operations. Virtual CFO offers financial management services tailored for startups and SMEs, providing expertise without the overhead of a full-time CFO. Code Zone is a strategic tech infrastructure acquisition meant to enhance Fawry’s technological capabilities.

Fawry’s latest move is part of a bigger shift seen across fintech companies in Africa: chasing enterprise clients over consumers. For example, Nigeria’s Flutterwave laid off 24 employees, about 3% of its staff, to double down on enterprise and remittances—two of its biggest revenue drivers. South Africa’s Stitch acquired ExiPay, an offline payment infrastructure provider, to entrench its value offering to the enterprise market it already serves.

For Fawry, there’s a strong incentive: it’s where the money is. In its 2024 half-year results, “Fawry Business,” which includes banking services, financial solutions for SMEs, and supply chain digitization, emerged as its biggest revenue driver.

Banking services, which cover card payment solutions via POS for large enterprises, saw a 70.2% year-on-year (YoY) increase, bringing in EGP 932.1 million ($18.4 million). Financial services, including SME lending, employee insurance brokerage, cash management, and payroll card solutions, recorded the highest growth at 113% YoY, though it generated less overall—EGP 377.7 million ($7.5 million). Meanwhile, supply chain solutions, which help merchants, suppliers, and sales agents digitise transactions, added EGP 160.1 million ($3.1 million) to the business.

With numbers like these, it’s clear why Fawry is doubling down on enterprise services. B2B is proving to be the company’s strongest growth engine, and its latest acquisitions only reinforce that direction. With these acquisitions, Fawry will deepen its services to large and small enterprises, and financial institutions, expanding its potential revenue basket.

Despite what seems like positive news, investor sentiment is saying otherwise; Fawry ($FWRY) traded at EGP 8 ($0.16) on the EGX at the close of market on Thursday, declining by 0.12%. However, the fintech giant will hope that this is only a minor slump as it picks up pace in the coming weeks leading to the announcement of its full-year financial performance.

Fawry currently has a market cap of EGP 26.49 billion ($523 million), nowhere near the $1 billion valuation that made it Egypt’s first unicorn before it went public. Yet, it remains one of the country’s most important fintechs.

Are you an Afincran?

If you’re building solutions for Africa, you already are. Join Fincra’s mission to empower Africa through collaborative innovation. Together, we’re building the rails for an integrated Africa. Join the Afincran movement—let’s drive change!

Telecoms

Africa’s internet is one cable cut away from chaos

Fixing a damaged submarine cable takes anywhere from five to fifteen days in Europe or North America. In Africa? Try six weeks—or longer. And when it does get fixed, it costs about $2 million per repair.

MainOne Equinix Solutions, Nigeria’s first private-led submarine cable operator, has suffered three major fiber cuts since its launch. Each repair dragged on for weeks, disrupting internet access in key cities like Lagos. Meanwhile, in March 2024, an underwater landslide off Côte d’Ivoire’s coast damaged four critical cables, leaving 13 West African countries—including Nigeria, Ghana, and South Africa—scrambling for months before full restoration.

Africa doesn’t have enough repair ships nearby, meaning vessels must be sent from other continents, wasting precious time. Governments don’t make things easier either—permits for repairs can take months and cost up to $1 million.

While North America and Europe have dozens of backup cables, Africa is dangerously reliant on just a handful. The continent has only 74 submarine cable systems, compared to Europe’s 152 and the U.S.’s 88. Worse, 90% of African countries don’t even have a single dedicated cable, making every break a potential catastrophe.

Solutions exist: regional investment in repair ships, faster government approvals, and more private-sector funding. The International Telecommunication Union (ITU) and the International Cable Protection Committee (ICPC) are pushing for better policies, but until governments and businesses act, Africa’s internet will remain one cable cut away from another blackout.

You can now integrate Paystack with GiveWP

GiveWP makes it easy to create donation pages and accept online donations on your WordPress site. With Paystack, you can securely receive payments for your donations effortlessly. Find out more here→

Streaming

Showmax slashes subscription to ₦1,000 for Nigerian users for one month

If you are Nigerian, here is a list of things you can do with ₦1,000 ($0.67): buy 2 pairs of the newly launched gala sausage rolls, tip a taxi driver or subscribe for the new Showmax mobile package.

On Thursday, Showmax, the streaming service owned by MultiChoice, introduced a new mobile plan in Nigeria, as it courts new subscribers.

From February 28 to March 31, 2025, Showmax will offer a promotional deal called “Showmax Shikini Season.” New and returning subscribers can sign up for the General Entertainment (GE) Mobile plan at ₦1,000 ($0.67), down from ₦1,600 ($1.07), while the All Devices plan will be priced at ₦2,000 ($1.33) instead of ₦3,500 ($2.33).

The move comes shortly after MultiChoice raised subscription fees for its DStv service. The new mobile plan comes one year after Showmax’s 2024 app revamp which saw the streaming platform rejig its content line up through a partnership with Comcast’s NBCUniversal and Sky, an upgrade to the Peacock platform.

The revamp, which focused on a mobile first approach saw Showmax introduce new mobile-only plans including for Premier League football at ₦2,900 ($1.93), which is significantly cheaper than DStv’s premium sports offerings. The streamer also introduced a mobile-only entertainment subscription that cost ₦1,200 ($0.8) a month, while a mobile bundle of entertainment and the Premier League will only cost ₦3,200 ($2.13).

Showmax’s new ₦1,000 ($0.67) plan comes at a time when many Nigerians are grappling with soaring data tariffs and other rising living costs. By offering a more budget-friendly option, the streamer hopes to draw in mobile users searching for affordable entertainment, while working toward its ambitious target of 50 million subscribers and $1 billion in revenue.

The plan will also appeal to customers looking for alternatives to pricier services without straining their wallets. The real test for Showmax’s new ₦1,000 ($0.67) plan will come in the weeks ahead, as Nigerians decide if the price point offers enough value and relief in today’s tight economic climate.

The Moonshot Deal Book is Coming!

Introducing the Moonshot Deal Book—our exclusive collection of the most promising and investable startups in Africa.

If you’re an investor looking for the most exciting investment opportunities on the continent, sign up to join the waitlist and you’ll be among the first to access this investor-focused resource once it is live. Join the waitlist.

Insights

Funding Tracker

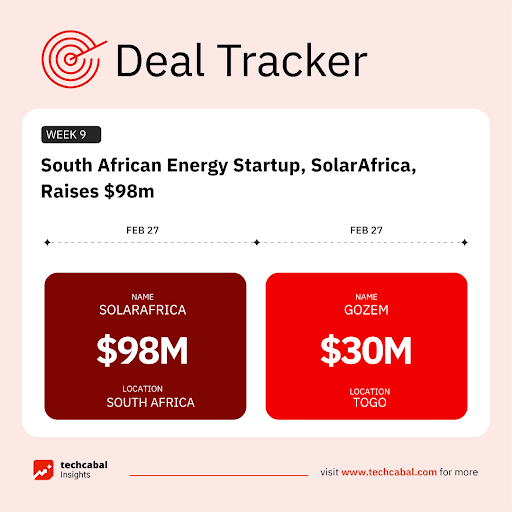

This week, SolarAfrica, an energy company, secured $98m in funding to implement the first phase of its 1 GW SunCentral solar project in South Africa. Investec and RMB backed the investment. (February 27)

Here’s the other deal for the week:

- Togo-based super app Gozem raised $30m in Series B funding, comprising $15m in equity and $15 M in debt. SAS Shipping Agencies Services and Al Mada Ventures led the funding round. (February 27)

Follow us on Twitter, Instagram, and LinkedIn for more funding announcements. Before you go, read our State of Tech in Africa review for 2024. Click this link to read it.

CRYPTO TRACKER

The World Wide Web3

Events

- GITEX AFRICA 3rd edition is NOW OPEN for registration. Africa’s largest tech and start-up event will be held from 14-16 April 2025 in Marrakech, Morocco. Attend to see the leading brands in tech, and the most innovative startups, and network with tech leaders, investors, speakers and government delegations from across Africa and across the globe. Register here.

Written by: Emmanuel Nwosu, Faith Omoniyi, and Mobolaji Adebayo

Edited by: Olumuyiwa Olowogboyega

Want more of TechCabal?

Sign up for our insightful newsletters on the business and economy of tech in Africa.

- The Next Wave: futuristic analysis of the business of tech in Africa.

- Entering Tech: tech career insights and opportunities in your inbox every Wednesday at 10 AM WAT.

- TC Scoops: breaking news from TechCabal

P:S If you’re often missing TC Daily in your inbox, check your Promotions folder and move any edition of TC Daily from “Promotions” to your “Main” or “Primary” folder and TC Daily will always come to you.

Uncategorized

African investment professionals earn 33% less than global counterparts due to smaller ecosystem

African investment professionals earn less than their global counterparts due to the smaller assets and funds they manage, according to data on salaries and assets under management in African investment firms by Dream VC, a venture capital institute, and A&A Collective, a global investment community.

The average annual salary for analysts at Africa-focused venture capital, private equity, and impact investment firms is $21,000. Outside Africa, that salary jumps by 33% to $28,000. At more senior levels, the gap widens—investment managers or principals outside Africa earn $40,000 more than a principal in Africa.

The African investment salary gap can be explained by the size of assets under management (AUM) by African funds, with the average firm managing around $87.5 million for private equity (PE) funds. Most venture capital (VC) funds manage only $50 million, while impact investment funds manage $58 million. This pales compared to global counterparts like Asia, where the average VC fund size is $324 million.

“This report brings much-needed transparency to compensation, strengthening the industry for both emerging and established investors,” Mark Kleyner, the co-CEO of Dream VC, told TechCabal about the report, which pulled data from 209 participants across 28 African countries.

Investment firms pay salaries and other operating costs out of fund management fees. Venture capital firms, which account for two-thirds of the firms sampled, charge a 2% annual management fee on the fund size, leaving 80% of the capital for deployment. If a VC firm raises a $25 million fund, it earns $5 million in management fees over a typical 10-year fund cycle.

With the median AUM by African investment firms at $50 million, most firms operate with a $1 million annual operating budget, directly causing the salary gap. This disparity risks triggering a brain drain, as investment professionals seek better-paying opportunities abroad, further shrinking the pool of experienced talent in Africa.

African funds may need to align compensation more closely with global benchmarks to retain leadership and expertise, especially as the ecosystem is younger than more mature markets and needs more experienced professionals. This may be possible in coming years as Africa’s ecosystem continues growing. In 2017, fifteen firms were founded for the first time; by 2022, that number had grown to 25.

Besides the young firms, Africa’s investment sector is also dominated by young professionals, with 73% under 34 and 42% aged 25–29, reflecting an industry that is packed with emerging talent. Entry-level roles like Analysts (19%) and Associates (24%) are prevalent, while senior positions such as Principals (6%) and Directors (4%) are fewer. This imbalance shows the need for more African fund managers to strengthen and expand the ecosystem.

Given how young the average professional is, it’s not surprising that over half of investment professionals hold bachelor’s degrees, while 40% have master’s degrees, including 15% with MBAs. Only 39% of professionals have studied abroad, highlighting the demand for local market knowledge—a competitive edge in Africa’s cross-border investment landscape.

Carry—an investor’s share of investment profits—remains elusive for most professionals in Africa’s investment sector. Only senior roles like principals and portfolio managers receive meaningful equity, with a maximum carry of 10%, though the average remains low at 0.016% for principals. This contrasts with global norms, where carry is a key retention tool.

Data around compensation among African employers and employees remain scarce, and with the report, the research team “sought to create a benchmarking study that could support salary transparency and help fund managers understand industry norms for compensation.”.

The data, Kleyner said, would also help firms “professionalise Africa’s investment landscape”—a necessity as global capital flows into the continent’s tech hubs like Lagos, Nairobi, and Accra.

You can read the full report for more context on the African investment salary gap here.

Uncategorized

Kenyan digital lender Whitepath fined $2,000 for unlawful data use in second privacy violation

Kenya’s Office of the Data Protection Commissioner (ODPC) has fined digital lender Whitepath KES 250,000 ($2,000) for violating data privacy laws. Court records show that the regulator found that Whitepath, which operates Instarcash and Zuricash loan apps, listed an individual as a guarantor without their consent and subjected them to debt collection calls after the borrower defaulted.

The fine—the company’s second in two years—adds to growing regulatory pressure on Kenyan digital lenders, who are scrutinized for aggressive debt collection tactics and mishandling customer data.

According to court documents seen by TechCabal, Dennis Caleb Owuor received an unexpected debt collection call from a Whitepath representative in November 2024. The caller claimed Owuor was listed as a guarantor for a defaulting borrower, despite Owuor having no prior agreement to such an arrangement. When he questioned the claim, the caller failed to provide any justification but continued to demand repayment. Despite Owuor’s instructions to stop, the calls persisted, prompting him to escalate the matter to the ODPC, alleging illegal privacy breaches and harassment.

Whitepath failed to respond to the regulator’s inquiries, but Kenya’s Data Protection Act allows enforcement regardless. The ODPC ruled that Whitepath had no legal basis to process the complainant’s data, as listing someone as a guarantor requires explicit consent— which was never obtained. The company also violated data protection laws by failing to notify them that their data was being used.

In addition to the fine, the regulator directed Whitepath to erase the complainant’s data and provide proof of compliance.

This is not Whitepath’s first data privacy violation. In April 2023, the ODPC fined the lender KES 5 million ($39,000) after nearly 150 complaints alleging unauthorised access to borrowers’ contact lists and sending unsolicited messages. The penalty came after Whitepath ignored an earlier enforcement notice.

Whitepath did not immediately respond to a request for comment.

The case highlights ongoing regulatory action against digital lenders using unethical data practices, including extracting contact details from borrowers’ phones, sharing debtor information publicly, and employing aggressive collection tactics.

While enforcement is increasing, concerns remain over whether current penalties are sufficient. A KES 250,000 ($2000) penalty may not significantly deter a firm that disregarded a KES 5 million fine in 2023. Stronger regulatory measures, including larger fines and criminal liability for repeat offenders, may be required to ensure compliance and protect consumer rights.

Uncategorized

After P2P trading, hybrid finance apps are taking off in Nigeria’s crypto space

As cryptocurrency adoption grows in Nigeria, founders are building hybrid finance apps to simplify access to crypto. These hybrid apps reduce the education barrier and overwhelming user experience flows common in crypto trading apps, allowing users to interact with cryptocurrency as easily as they do with fiat money on their traditional mobile banking apps.

Hybrid finance apps integrate traditional finance (TradFi) and decentralised finance (DeFi) features that allow users to buy, sell, or convert crypto to Naira without the need for an escrow or peer-to-peer (P2P) trading. Since mid-2023, startups like Taja, Palremit, Prestmit, Azasend, and Pandar have sprung up to create these hybrid solutions to enable more Nigerians to take part in the crypto sector. At least 20 such startups currently operate this hybrid finance model in Nigeria.

“I’ve only used Bybit when I had small amounts of Dogecoin and Bitcoin in my wallets,” said David Ayankoso, a non-frequent crypto user based in Lagos. “I find the process of exchanging crypto on Bybit to be complicated. The app is overloaded and not as simple as some other platforms. So instead, I buy Solana or Bitcoin elsewhere [on hybrid finance apps] and transfer it to my Phantom wallet to buy or trade random altcoins.”

Nigeria is one of the hotspots for crypto adoption globally, yet that high transaction value is only spread among a few knowledgeable people in the Web3 space. Sending and receiving crypto doesn’t quite work like fiat currencies in traditional banks. With one wrong click, funds are prone to losses, and bank accounts to freezes, making many Nigerians averse to digital assets.

The pitches of these hybrid finance startups often go like this: if you’re not familiar with the crypto P2P trading setup, use a hybrid finance app to avoid overwhelming yourself with the process of dealing with an escrow—or worse, getting scammed. Users simply open an account, gain access to a virtual account (a service hybrid finance apps provide through partnerships with payment processors), fund the account, and buy crypto directly from the app.

“Founders who build these apps see an opportunity to take advantage of a ‘grassroot movement’,” said Ayo Adewuyi, head of product at Prestmit, who claims the startup has over 700,000 users, thanks to additional features like gift card trading which attracts users from several countries. “For example, one of the reasons Patricia [one of the earliest to use this model] was an important crypto hybrid app was because people saw it as a Nigerian brand that wanted to localise crypto. Founders saw this and tapped into it.”

The clampdown on P2P trading and the strict regulatory oversight on big crypto exchanges paved a way for hybrid apps to thrive, said Adewuyi. He claimed Prestmit’s users grew significantly after large crypto exchanges deprioritised the Nigerian market.

While hybrid finance apps are not new, there is a growing focus on integrating crypto payment options into traditional finance systems. Beyond buying crypto for investment holdings, these apps let users manage digital assets like local currencies. They can pay bills, buy airtime and data, trade gift cards, send crypto directly to others through app tags, and pay for online services with crypto. Hybrid finance apps are also important to freelancers who earn in crypto, allowing them to convert to their local currency without relying on the P2P space.

Unlike building a crypto trading app, for example, operating a hybrid finance model is a much simpler setup. These startups provide three key things: the platform (proprietary technology like an app or a web-app), virtual accounts for user account management, and crypto liquidity.

Imagine walking into a mom-and-pop shop in your neighbourhood. With cash in hand—your local currency—you ask the storekeeper to sell you a crypto asset, say Bitcoin. The storekeeper collects your money, and two things could happen: either they process your order as the counterparty because they have the means, or they use a back-door service to obtain the required amount of crypto to sell to you. Either way, the hybrid app remains the counterparty to every trade. Most of these apps rely on crypto infrastructure providers to enable users to buy and sell crypto, while some outsource liquidity to over-the-counter (OTC) traders and institutions that provide bulk crypto liquidity.

“Liquidity is not manufactured out of thin air; liquidity providers, in some cases, are the P2P guys just that in this case, they go through a much more rigorous KYC process because startups want to be sure that the funds they are receiving are not illegal,” said Adewuyi.

The result of this outsourced liquidity often means that users have to play by the rules of the providers. Most liquidity providers cap the minimum amount of crypto users can buy or sell, which can be a bad experience for people buying or exchanging small amounts. For example, Luno, which can be considered a hybrid startup, allows users to offload their Bitcoin liquidity from 0.000025 BTC ($2.03), which means users cannot sell or off-ramp their coins below this amount. Some apps set the minimum crypto sell-off amount higher.

Since hybrid finance apps primarily make money from transaction fees, the costs are higher compared to trading platforms. Users get charged a percentage of their deposits on some of these platforms, and when they try to exchange, they do so at a higher, marked-up rate than the official exchange rate. In P2P trading apps, where liquidity is provided by traders who are directly responsible for their revenue, competition drives down prices.

“A lot of people are not interested in the complex part of crypto, and hybrid apps come in here. They provide the liquidity that users need at a specific rate, and if you’re fine with it, you go through with the transaction,” said Adewuyi.

Yet, hybrid finance apps pitch their tent on the value they provide—insurance from the risk factor found in trading apps—while extracting a few dollars in charges from customers. In the grand scheme of things, many of them do not operate as crypto exchanges, eliminating token listing fees as a possible revenue source.

Despite their dual nature, most so-called hybrid finance apps tilt more toward their traditional finance side than crypto, qualifying them more as fintechs than crypto startups. With this distinction, they are more bound by fintech rules than by the rules governing crypto startups in Nigeria’s evolving regulatory structure.

The broader trend has seen TradFi platforms integrate DeFi solutions into their products in attempts to find a balance. Uganda’s Eversend and Nigeria’s Grey, two traditional cross-border fintechs, have integrated stablecoin payments into their apps to appeal to Web3 freelancers who earn money in digital assets.

Hybrid finance apps are products of founders’ conviction that onboarding users into the utility side of crypto—as everyday money—is the future-forward way digital assets are developing. It also suggests that P2P, despite its faults, has no shortage of admirers who make crypto an insider affair. These apps are responses of founders for all those who feel left out.

-

Uncategorized2 weeks ago

Court freezes bank accounts over ₦5.7 billion Keystone Bank transfer glitch

-

Uncategorized3 weeks ago

Uncategorized3 weeks agoNigeria’s Central Bank holds interest rate at 27.50% after CPI rebasing

-

Uncategorized2 weeks ago

Access Bank’s phased software update promised stability but customers are struggling

-

Uncategorized2 weeks ago

Beyond Chowdeck and Glovo, here are 10 startups shaping Nigeria’s food delivery space

-

Uncategorized2 weeks ago

Breaking: 54 Collective to cut jobs as Mastercard Foundation partnership ends

-

Startups3 weeks ago

Startups3 weeks agoKenya’s Ebee Mobility faces higher tax bill after losing e-bike classification appeal

-

Uncategorized2 weeks ago

Uncategorized2 weeks ago👨🏿🚀TechCabal Daily – Sterling Bank raises salaries again

-

Uncategorized2 weeks ago

Sterling Bank raises entry-level pay to ₦528,000 in company-wide salary review